When investing, make every dollar count. Invest in Unit Trust which are professionally managed, to help you grow your wealth.

A Unit Trust invests a pool of money, collected from a number of investors, in a range of assets. By pooling your money with that of other investors, you’ll be able to invest in a wide range of assets. Successful investments in the assets add value to the fund and their returns are then distributed back to investors.

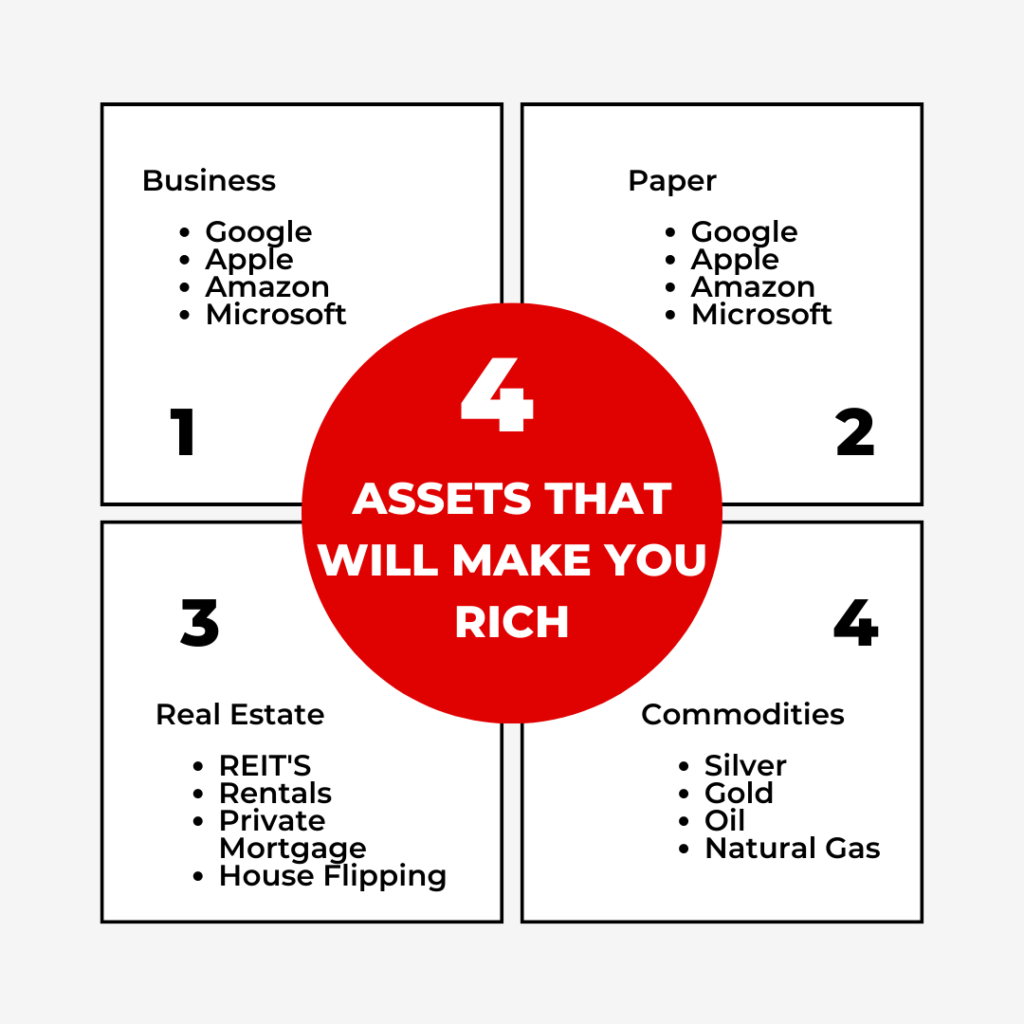

Unit Trusts are collections of different assets and commonly invest in stocks or bonds or a mix of both. To reduce risks, these investment assets are diversified in geographical markets and industry types.

Funds that invest solely in stocks (stocks are shares of a company)

Funds that invest solely in bonds (bonds are loans to an entity that earn fixed or variable interest for an defined period of time)

Funds that invest in a mix of stocks and bonds

Funds that invest in a range of companies that closely match and/ or track companies comprising a particular index

Money market funds invest in liquid, low risk money market instruments that are in effect short-term deposits (loans) to banks and other-low risk-financial institutions, and in short-term government securities. Hence, money market funds in general have relatively lower risk and provide stable income returns.

International equity funds are funds primarily invested in overseas stock markets.

by fund managers who have greater access to investment information and tools. you can therefore benefit from their expertise and full-time attention give n to research.

by investing in a diversified collection of assets.

as most Unit Trusts can be redeemed daily, freeing up cash as you need it.

as it allows you to start investing from just RM100/month or a minimum lump sum of RM1,000.

enabled by a bigger investment capital pooled from a group of investors.

Privacy Policy. @2023-2024 Copyright

Privacy Policy. @2023-2024 Copyright